Fate of US Steel’s Deal with Japan’s Nippon Now Rests with President Biden

Fate of US Steel’s Deal with Japan’s Nippon Now Rests with President Biden

Blog Article

- Source: san.com

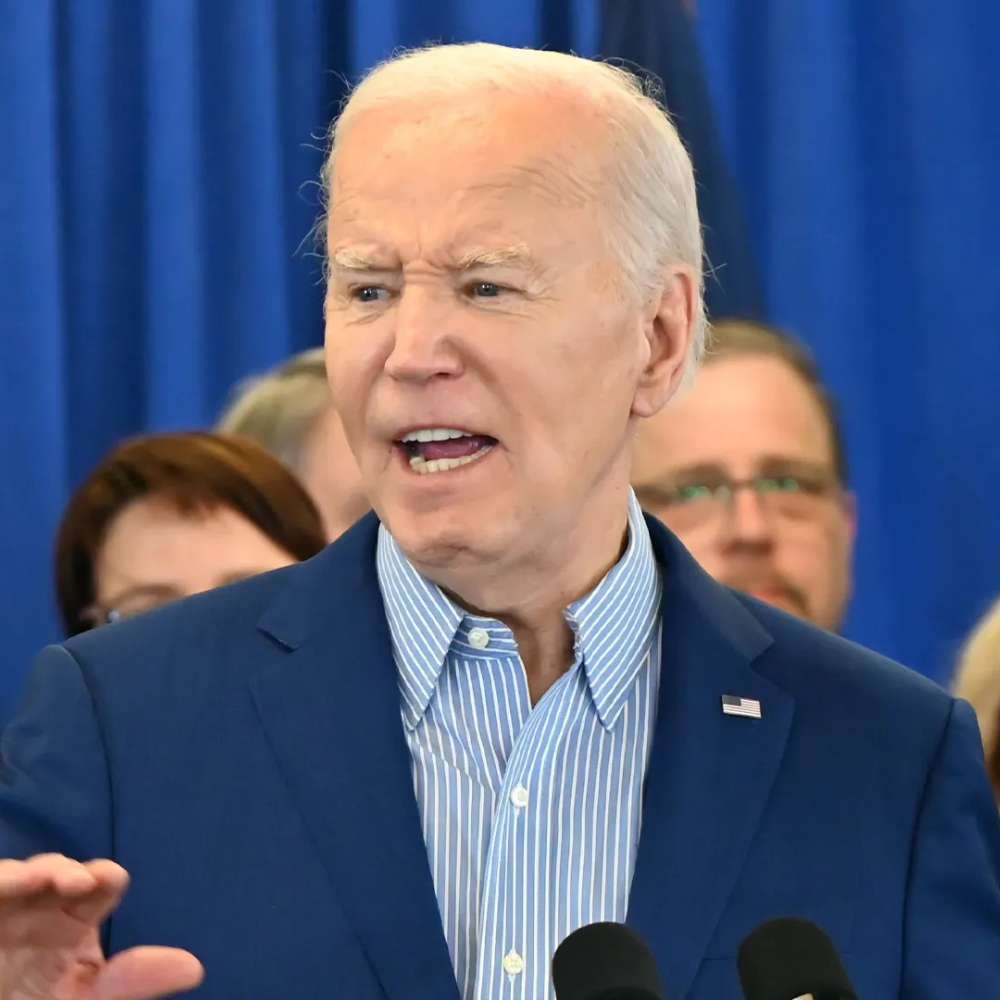

The fate of the proposed acquisition of US Steel by Japan’s Nippon Steel is now in the hands of President Joe Biden. A committee of senior officials from key government agencies, known as the Committee for Foreign Investment in the United States (CFIUS), has been unable to reach a consensus on whether the deal poses a national security risk, according to sources familiar with the matter.

CFIUS, which is tasked with reviewing foreign investments in U.S. companies to ensure they do not jeopardize national security, submitted its findings to Biden without a unified decision. This deadlock has left the final determination to the president, who has signaled his opposition to the deal. Biden has consistently argued that US Steel should remain under American ownership to protect domestic steel jobs.

CFIUS Review and National Security Concerns

CFIUS is composed of high-ranking officials from the president’s Cabinet, with the Treasury Department leading the committee. Typically, the committee’s review and recommendations influence the president’s decision on whether to block a deal. In this case, however, CFIUS members faced internal disagreements on the national security implications of the acquisition.

Public opposition to the deal by Biden, Vice President Kamala Harris, and President-elect Donald Trump added further complexity to the review process. This public stance reportedly frustrated some CFIUS officials, who felt the political climate interfered with the committee’s ability to evaluate the deal on its merits.

Both US Steel and Nippon Steel have maintained that the acquisition does not pose any national security threat. The companies have not yet responded to requests for comment.

Nippon’s Offer and US Steel’s Struggles

Japan’s Nippon Steel agreed to acquire US Steel over a year ago, offering nearly twice the price proposed by Cleveland-Cliffs, a U.S.-based rival. To gain approval, Nippon pledged to invest $2.7 billion in US Steel’s facilities, including unionized mills near Pittsburgh and in Gary, Indiana.

US Steel, which has faced decades of financial challenges due to competition from cheaper foreign steel, particularly from China, sees the deal as crucial for its survival. In September, the company warned that without Nippon’s investment, it might have to close several of its mills, putting unionized jobs at risk. The company argued that the proposed merger would provide the necessary resources to modernize its operations and stabilize its finances.

Despite Nippon’s commitments, the proposed merger has drawn widespread criticism from politicians on both sides of the aisle, who view it as a threat to American manufacturing. The deal has become a political flashpoint, with leaders emphasizing the importance of safeguarding domestic steel production.

Additional Challenges and Uncertainty

The CFIUS review is not the only hurdle facing the merger. The U.S. Department of Justice also conducts an antitrust review of the proposed acquisition, which could present further complications.

Whether Biden will outright block the deal or allow negotiations between US Steel, Japan’s Nippon Steel, and the United Steelworkers union to find a mutually acceptable solution remains unclear. Even if a compromise is reached, the deal could face further opposition from President-elect Trump, who has vowed to block it once he takes office.

Trump has pledged to prioritize domestic steel production through tax incentives and tariffs, expressing his opposition to the merger. In a recent statement, he reiterated his commitment to strengthening U.S. Steel, clarifying that he does not support foreign ownership of the company.

The Path Ahead

As the decision now rests with Biden, the future of US Steel and its unionized workforce hangs in the balance. The outcome of this high-stakes deal with Japan’s Nippon Steel will have significant implications for the domestic steel industry, American manufacturing, and U.S.-Japan trade relations. Whether Biden blocks the acquisition or seeks a compromise, the decision will set the tone for how foreign investments in critical industries are handled under his administration.